Our History

Here’s how this Vermont Community Bank has grown through the years.

Community National Bank will be hosting Customer Appreciation Celebrations throughout our communities in July and August.

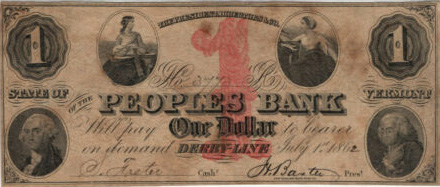

We’ve been serving our Vermont communities for over 165 years. Organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. In 1975 we purchased the Island Pond National Bank and changed our name to Community National Bank.

Today we have 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin and Lamoille counties. We also have 2 loan production offices, one in Chittenden county and the other in Grafton county New Hampshire.

We offer a complete line of personal and business products and services along with offerings for non-profit organizations, municipalities and local governments. We’re one-third owner Community Financial Services Group, LLC, our trust and investment affiliate.

Our contributions to the community, our lending practices and our employee volunteerism make us a genuine community bank, Vermont’s Community Bank. Community National Bank’s corporate color is blue; “true blue” because of our dedication to staying true to our mission proudly displayed in each office.

Collectively channeling our passions for people and community into delivery of financial solutions.

Here’s how this Vermont Community Bank has grown through the years.

This website uses cookies to ensure you get the best experience. Read our Website Policy to learn more about our use of cookies.

You are about to leave the Community National Bank website and enter a linked site. The link is provided for your convenience and should not be considered as an endorsement of the products, services, or information provided, or an assurance of the security provided at the linked site. Do you want to continue to this webpage?

Please be aware that email is not a secure method of communication. Do not use email to send us confidential or sensitive information such as passwords, account numbers or Social Security numbers. To send a secure message to us, please use our contact us form. Do you want to continue?